cryptocurrency tax calculator india

In addition to 30 of the tax you. Please tell us how does a trader need to calculate.

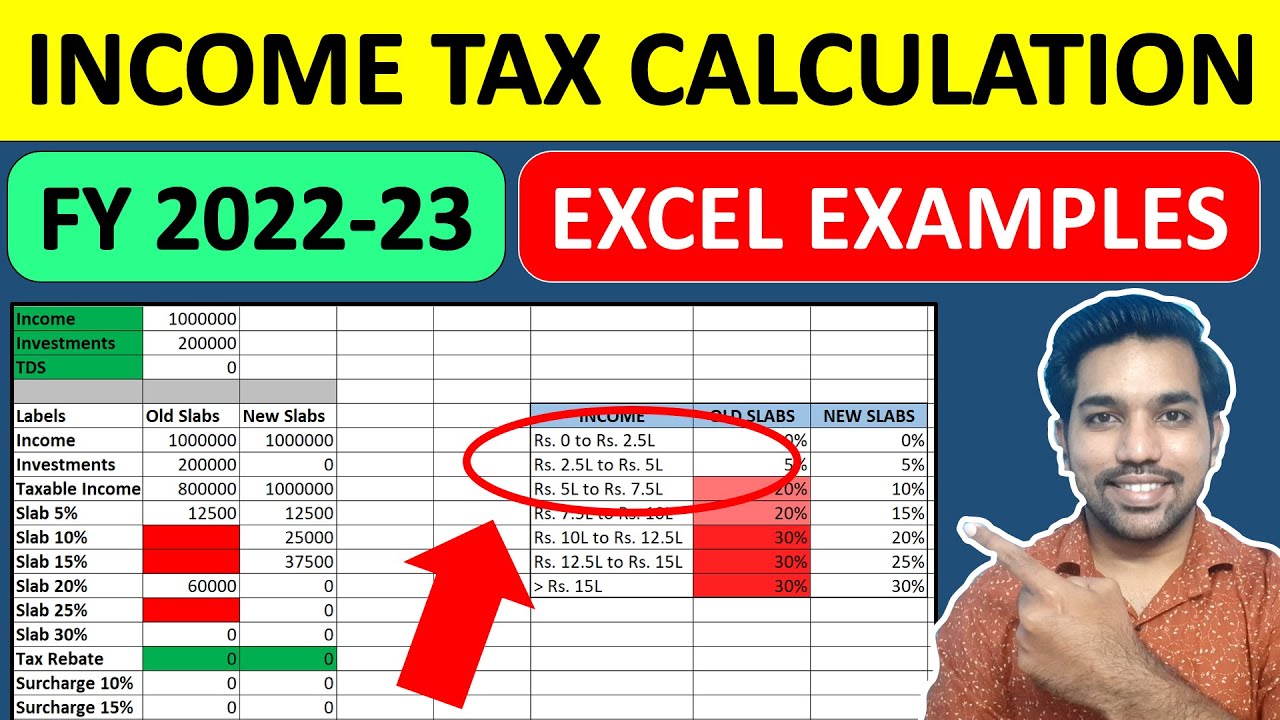

Crypto Tax Calculator India Income Tax Calculation On Cryptocurrencies Nft Explained Youtube

While India awaits a crypto-specific legislation the government seems to be further affirming its stance in relation to levy of tax on cryptocurrency.

. Selling crypto for fiat Selling crypto for fiat currency like INR is subject to a flat Income Tax of 30. Taxation on Cryptocurrency. Enter your total buying price of all the cryptocurrencies.

The ClearTax Bitcoin Tax Calculator shows you the income tax liability on cryptocurrency income. BearTax - Cryptocurrency Tax Software for India BearTax - Calculate Crypto Taxes in India Indias first crypto accounting and tax tool which has been vetted by a Chartered Accountant. Ad Join the New Digital Economy with TradeStation Crypto to Learn About Invest in Crypto.

1 lakh profit of Ethereum minus 50k loss of Bitcoin equals to. Fund Your Account and Start Trading Cryptocurrencies Today. Many Indians are investing in Crypto.

Getting Started is Easy. How To Use The India Cryptocurrency Tax Calculator. How will cryptocurrency earnings be taxed.

Cryptocurrency regulation - India is working on legislation to regulate cryptocurrencies but no draft has yet been released publicly. The steps to use the cryptocurrency tax calculator are mentioned hereunder. As per budget 2022 you will have to pay tax 30 on profit on the sale of any virtual digital.

Following are the steps to use the above Cryptocurrency tax calculator for India. If yes what are they. Cryptocurrency Income Tax Calculation.

Enter the amount of net proceeds received upon sale of cryptocurrency. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. Cryptocurrency Tax Calculation 2022.

To calculate tax on cryptocurrency you have to deduct the purchase price from the selling price of cryptocurrencies you hold and calculate 30 of the value. Tax Calculation Cryptocurrency Cryptocurrency is an emerging digital asset. If you sell both of them in the same financial year then this is how to calculate tax on cryptocurrency in India.

It is kept at a flat 30 on income from the transfer. Union budget 2022 proposed a scheme for the taxability of cryptocurrency. Yes - youll pay tax whenever you sell cryptocurrency in India with no exceptions.

You can not save tax if you will trade in cryptocurrency in India after 01042022. Lets take a closer look at each of them. CryptoTraderTax is the easiest and most intuitive crypto tax calculating software.

Indias decision to impose a 30 tax on profits from cryptocurrency trading is turning out to be a boon for the countrys digital-asset exchanges. In her speech for Union Budget 2022 Finance Minister Nirmala Sitharaman announced the new rules to bring cryptocurrency and NFT transactions under the tax net. Analysts picture four scenarios in which crypto assets can be taxed in India.

For example you have bought some Cryptocurrency units in April 2018 for Rs 80000 and sold them for Rs. The income tax liability calculated above is only for income. Ad Join the New Digital Economy with TradeStation Crypto to Learn About Invest in Crypto.

For example you might need to pay capital. Please tell us if the tax department is using any tools to track cryptocurrency transactions in India. Many Indians are investing in Crypto.

It serves as a one-stop shop to handle cryptocurrency tax reporting for all types of. Fund Your Account and Start Trading Cryptocurrencies Today. Getting Started is Easy.

Enter the cost of investment. Heres how to calculate tax if investing in cryptocurrencies and NFTs in India. When Indias government unveiled a plan to tax crypto assets in February it was the 30 rate on income from digital-asset investments that grabbed headlines.

Same as like you need data for calculating other Capital Gain Tax. Seeing a phenomenal increase in bitcoins or other cryptocurrency transactions. In the budget 2022 new rules related to the taxation of cryptocurrencies have been introduced.

- In the meanwhile a central bank.

Cryptocurrency Tax Guides Help Koinly

Crypto Tax Calculator India Income Tax Calculation On Cryptocurrencies Nft Explained Youtube

Explained How Will Crypto Taxation Work In India

Petition To Reduce 30 Crypto Tax In India Garners Over 15 000 Signatures In Hours Finbold

Taxation Of Crypto Wazirx Blog

Cryptocurrency Tax Guides Help Koinly

These Indian Companies Accept Bitcoin Payments In India Goodreturns

Cryptocurrency Tax Calculation 2022 What Will Be Taxed What Won T How And When Explained The Financial Express

Capital Gains Tax Calculator Ey Us

Flat 30 Cryptocurrency Tax Rate Why Crypto Investors Should Be Happy The Financial Express

How Bitcoins Taxed In India Eztax Money

Income Tax Calculator How Cryptocurrency Investors Will Be Taxed From April 1 Mint

Crypto Tax Calculator Bitcoin Ethereum Doge And Other Cryptocurrencies Coins Tax2win

Crypto Tax Calculator Bitcoin Ethereum Doge And Other Cryptocurrencies Coins Tax2win

5 Best Crypto Tax Software S Top Bitcoin Tax Calculator 2022 Coinmonks

5 Best Crypto Tax Software S Top Bitcoin Tax Calculator 2022 Coinmonks

India S Giant Crypto Market Will Come Under Taxation From Today